Top Motivational Quotes for Work to Boost Team Spirit

Sometimes employee moral is down. Sometimes employee motivation and productivity is low. Rally the troops with motivational quotes. Perfect for starting meetings & presentations or writing a memo to the team. Quotes can be a powerful tool to make a point, convey truths, and get results. Here is a list of 99 motivational and inspirational quotes for employees. Whether it is to emphasize that "Attitude is Everything", spotlight the importance of Teamwork, or cultivate a Customer Service culture, these quotes are sure to motivate your employees.

Employee Motivational Teamwork Quotes

"Teamwork is the ability to work together toward a common vision. The ability to direct individual accomplishment toward organizational objectives. It is the fuel that allows common people to attain uncommon results." - Successories

"Great things are done by a series of small things brought together" - Vincent Van Gogh

"Coming together is a beginning... Keeping together is progress... Working together is a success." - Henry Ford

"To stand apart from the competition, you must first stand together as a team." - Successories

"Problems become opportunities when the right people join together." - Successories

"The strength of the team is in each individual member... the strength of each member is in the team." - Successories

"When a team of dedicated individuals makes a commitment to act as one...the sky's the limit." - Successories

"It is our differences that bring us together. It is our differences that make our ideas more meaningful. It is our differences that create a team that is one of a kind." - Successories

"Be strong enough to stand alone, be yourself enough to stand apart, but be wise enough to stand together when the time comes." - Successories

"Stand together as a team. With integrity, vision, and determination together you will succeed where others cannot." - Successories

"It is a fact that in the right formation, the lifting power of many wings can achieve twice the distance of any bird flying alone." - Successories

Employee Motivational Attitude Quotes

"Excellence is not a skill. It is an attitude." - Ralph Marston

"Attitude is a little thing that makes a big difference." - Winston Churchill

"A positive attitude causes a chain reaction of positive thoughts, events and outcomes. It is a catalyst...a spark that creates extraordinary results." - Successories

"Ability is what you're capable of doing. Motivation determines what you do. Attitude determines how well you do it." - Lou Holtz

"It is our attitude at the beginning of a difficult task which, more than anything else, will affect Its successful outcome." - William James

"It's not what happens to you that determines how far you will go in life; it is how you handle what happens to you." - Zig Ziglar

"The day is what you make it! So why not make it a great one?" - Steve Schulte

"It's not the load that breaks you down, it's the way you carry it." - Lou Holtz

"Believe you can and you are halfway there." - Theodore Roosevelt

"Take time out every day to be thankful for the people in our lives that drive us toward the path of success and for those that have helped us get to where we are today. Have an attitude of gratitude." - Successories

"Keep your face to the sun and you cannot see the shadows" - Helen Keller

"Your attitude, almost always determines your altitude in life." - Successories

"The one thing that you have that no one else has is you. Your voice, your mind, your story, and your passion. Start every day your way." - Successories

Employee Motivational Quotes about Solutions

"We can't solve problems by using the same kind of thinking we used when we created them." - Einstein

"The secret of change is to focus all of your energy, not on fighting the old, but on building the new." - Socrates

"If the only tool you have is a hammer, you tend to see every problem as a nail." - Abraham Maslow

"It takes courage to step off of the familiar to embrace the new and unknown future. But when you do, the possibilities are endless." - Successories

"In the confrontation between the river and the rock, the river always wins...not through strength but by perseverance." - Successories

"Take the initiative and lead the way. You can make the difference." - Successories

"A leader's job is to look into the future, and to see the organization not as it is...but as it can become." - Successories

Employee Motivational Quotes about Excellence

"Excellence is not a skill. It is an attitude." - Ralph Marston

"Excellence is the result of caring more than others think is wise, risking more than others think is safe, dreaming more than others think is practical, and expecting more than others think is possible." - Successories

"Do what you know is right...always. With commitment to your deepest convictions you stand tall against time and tide." - Successories

"Excellence is never an accident; it is the result of high intention, sincere effort, intelligent direction, skillful execution and the vision to see obstacles as opportunities." - Successories

"What we can easily see is only a small percentage of what is possible. Imagination is having the vision to see what is just below the surface; to picture that which is essential, but invisible to the eye."

"Your true character is revealed by the clarity of your convictions, the choices you make, and the promises you keep." - Successories

"True strength is not in showing the world how strong you are but having the strength to win the battles the world knows nothing about." - Successories

"Each day begins with new hope. Make today a day filled with a commitment to excellence." - Successories

Employee Motivational Success Quotes

"The secret of getting ahead, is getting started." - Mark Twain

"When your work speaks for itself, don't interrupt." - Henry J. Kaiser

"Well done, is better than well said." - Benjamin Franklin

"Success means doing the best we can with what we have. Success is the doing, not the getting; in the trying, not the triumph. Success is a personal standard, reaching for the highest that is in us, becoming all that we can be." - Zig Ziglar

"Do not be embarrassed by your failures, learn from them and start again." - Richard Branson"

"Success is going from failure to failure without losing enthusiasm." - Winston Churchill

"Some people want it to happen, some wish it would happen, others make it happen." - Michael Jordan

"Approach every challenge with a level head, unwavering focus and a determination to light the way for others to succeed." - Successories

"Courage is rightly esteemed the first of human qualities because it is the quality which guarantees all others." - Winston Churchill

"Discipline is the bridge between goals and accomplishments." - Successories

"It is attitude, not circumstance, that makes success possible in even the most unlikely conditions." - Successories

"The road to success is sometimes long and arduous. It takes unwavering commitment and a will to succeed in order to complete the journey." - Successories

"Success is not by chance, it takes someone willing to climb a mountain full of obstacles and challenges. It may seem insurmountable from a distance, but if you imagine with all your mind and believe with all your heart, you will reach the top." - Successories

"Successful is the person who has lived well, laughed often and loved much, who has gained the respect of children, who leaves the world better than they found it, who has never lacked appreciation for the earth's beauty, who never fails to look for the best in others or give the best of themselves." - Successories

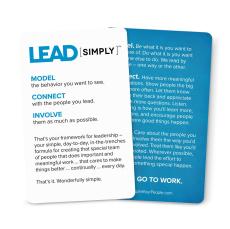

Leadership Quotes for Employees

"Leadership is about capturing the imagination and enthusiasm of your people with clearly defined goals that cut through the fog like a beacon in the night." - Successories

"A true leader has the confidence to stand alone, the courage to make tough decisions, and the compassion to listen to the needs of others. A person does not set out to be a leader, but becomes one by the quality of one's actions and the integrity of one's intent. In the end, leaders are much like eagles... they don't flock, you find them one at a time." - Successories

Customer Service Motivational Quotes

"Service is the lifeblood of any organization. Everything flows from it and is nourished by it. Customer service is not a department... it's an attitude." - Successories

Quote - Author

"Extraordinary service is the result of anticipating the need and providing the solution before the customer requires it" - Successories

"Accountability is paramount. It is easy to dodge responsibilities, but regardless of conditions the consequences of avoidance cannot be dodged." - Successories

"The high road to service is traveled with integrity, compassion and understanding; people don't care how much we know until they know how much we care." - Successories

Employee Motivational Quotes about Action

"Greatness is not in where we stand, but in what direction we are moving. We must sail sometimes with the wind and sometimes against it - but sail we must and not drift, nor lie at anchor." - Oliver Wendell Holmes

"Every morning in Africa, a gazelle wakes up. It knows it must run faster than the fastest lion or it will be killed...every morning a lion wakes up. It knows it must outrun the slowest gazelle or it will starve to death. It doesn't matter whether you are a lion or a gazelle...when the sun comes up, you'd better be running." - Proverb

"Change is life giving. It helps us grow into someone greater than we already are." - Successories

"Amateurs sit and wait for inspiration, the rest of us just get up and go to work." - Stephen King

"Things may come to those who wait, but only the things left by those who hustle." - Abraham Lincoln

"Take the first step in faith. You don't have to see the whole staircase, just take the first step." - Martink Luther King Jr.